Mansfield Constituency Labour Party For Mansfield, Mansfield Woodhouse and Warsop

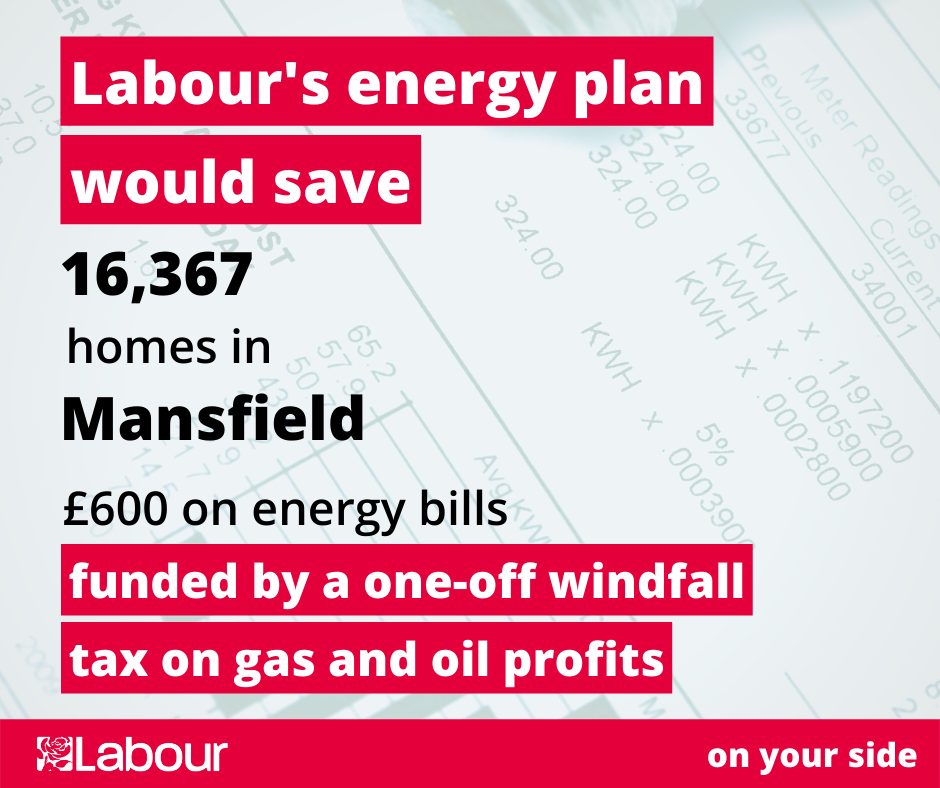

New analysis published by Mansfield Labour today reveals that 16,367 homes would benefit from £600 to help with energy bills under Labour’s plan.

The plan would be fully funded by a windfall tax on the bumper profits of oil and gas companies

The Conservative response to the cost of living crisis includes raising taxes – including National Insurance for all workers and businesses, and an energy bills loan which must be repaid.

Mansfield Labour’s Andy Abrahams said,

“Labour has a plan to deal with the cost of living crisis. We would scrap the National Insurance rise, and our plan to help with energy bills would mean 16,367 households in Mansfield save £600. What’s more Labour councils keep council tax on average more than £300 lower than Tory councils. Just this year, I was able to freeze council tax for Mansfield District whilst the Tory controlled County Council imposed hikes affecting us all.

“While the Conservatives are either standing aside or mired in scandal, Labour is on your side with real help to tackle the cost of living crisis.”

ENDS

Notes to Editors

1 in 3 households would save £600 from their energy bills under Labour.

In Mansfield that would mean 16,367 homes receiving the full £600 under the plan

Labour’s Proposal

To address the immediate crisis, Labour would bring in fully-funded measures now to reduce the price rise in April – saving most households around £200 or more, but targeted extra support to squeezed middle, pensioners and the lowest earners, receiving up to £600 off bills and preventing all of the increase in energy bills currently expected.

1. Removing VAT on domestic energy bills for a year from April 2022: We would remove VAT on domestic energy bills for 12 months from April 2022. There are 28.5m households in the United Kingdom connected to the electricity grid (Source: FT). The saving they would each receive depends on their own domestic energy consumption and the price of domestic energy.

2. Expanding and increasing the Warm Homes Discount: currently only 2.2m households get the £140 Warm Homes Discount on their energy bills, despite 4.3m households being eligible to receive the payment, including low-income pensioners and working-age households with young children or disabilities.

The Government has already budgeted to spend £0.5bn next financial year on the Warm Homes Discount, according to a document published in 2021. We would increase that budget to £4bn, an additional £3.5bn, sufficient to provide a £400 Warm Home Discount to the 9.3m households who would be eligible to receive it (around a third of all households in Great Britain), as well as covering the extra administration costs (estimated at £19 per household). This budget would also cover Barnett consequentials for Northern Ireland.

Households who would be newly eligible include all working families with children that are Claiming Universal Credit – currently only those working with income below £16,190 AND a disabled child or a child aged under 5 get it, so many families with children on low to middle incomes will be newly eligible. In addition, our plan would extend eligibility to the 220,000 pensioners in the savings credit group of pension credit and not on guarantee credit, those on a low income but who have some savings from before they retired.

3. Smoothing the costs of supplier failure: Citizens Advice estimate that supplier failures since August 2021 will cost £2.6bn, or £94 per customer (Source: Citizens Advice). These costs will form part of the policy costs charged to bill payers and will be factored into the new energy price cap figure, scheduled to be announced on the 7th February. Ofgem are consulting on a mechanism to smooth the impact of current extraordinary SoLR lvy payments. To prevent these costs going onto bills in April, we would lend money to suppliers, reducing the level of the price cap by £94 for a typical customer. We would urgently begin work with the regulator and energy suppliers to set a schedule for how in future years these loans would be repaid and over what timescale, at no overall cost to the exchequer.

4. Contingency Fund: in addition to the above measures, we would allocate £600m to a contingency fund that could be used to support energy intensive businesses or for other purposes related to the energy price rise.

The plan is funded through a Windfall Tax on North Sea Oil and Gas:

Table 3.4 of the October 2021 Economic and Fiscal Outlook says that UK oil and gas receipts will total £2.5bn in 2022/23. Paragraph 3.45 of the October 2021 Economic and Fiscal Outlook says that between the point at which the forecast closed and the point at which it was published, oil and gas prices rose such that a further £2.3bn in UK oil and gas receipts is expected in 2022/23. That means the OBR expected in October that a total of £4.8bn in oil and gas receipts is coming in 2022/23. Profits from North Sea Oil and Gas are currently taxed at 30% Corporation Tax plus a 10% corporation tax supplementary charge. Therefore increasing the rate of tax from 40% to 50%, for example, would raise tax revenue by £1.2bn. This is likely to be an underestimate given prices have risen further since the OBR made their assessment in October.